For foreign investors, choosing to incorporate a business in Puerto Rico offers many of the benefits of operating in Latin America, while also retaining some of the advantages enjoyed doing business at home.

While Puerto Rico is a Spanish speaking territory with a distinctly Latin American and Caribbean culture, it is also a US territory, with strong links to the United States and similar administrative processes.

For anyone planning a short-term or limited-scale engagement with the Puerto Rican market, hiring local staff via a professional employer organization (PEO) could be a good alternative to incorporating a company.

When you hire through a PEO in Puerto Rico, you avoid the need to establish and later liquidate a local entity. And you are able to get to work quicker, waiting only as long as it takes to find staff.

For those committed to entering the market on a more permanent basis, company incorporation in Puerto Rico requires five key steps, which are highlighted below after some insight into what makes the territory an enticing destination for investment.

Contact us today to find out how we can support you doing business in Puerto Rico.

Table of Contents

Puerto Rico Popular Among Investors

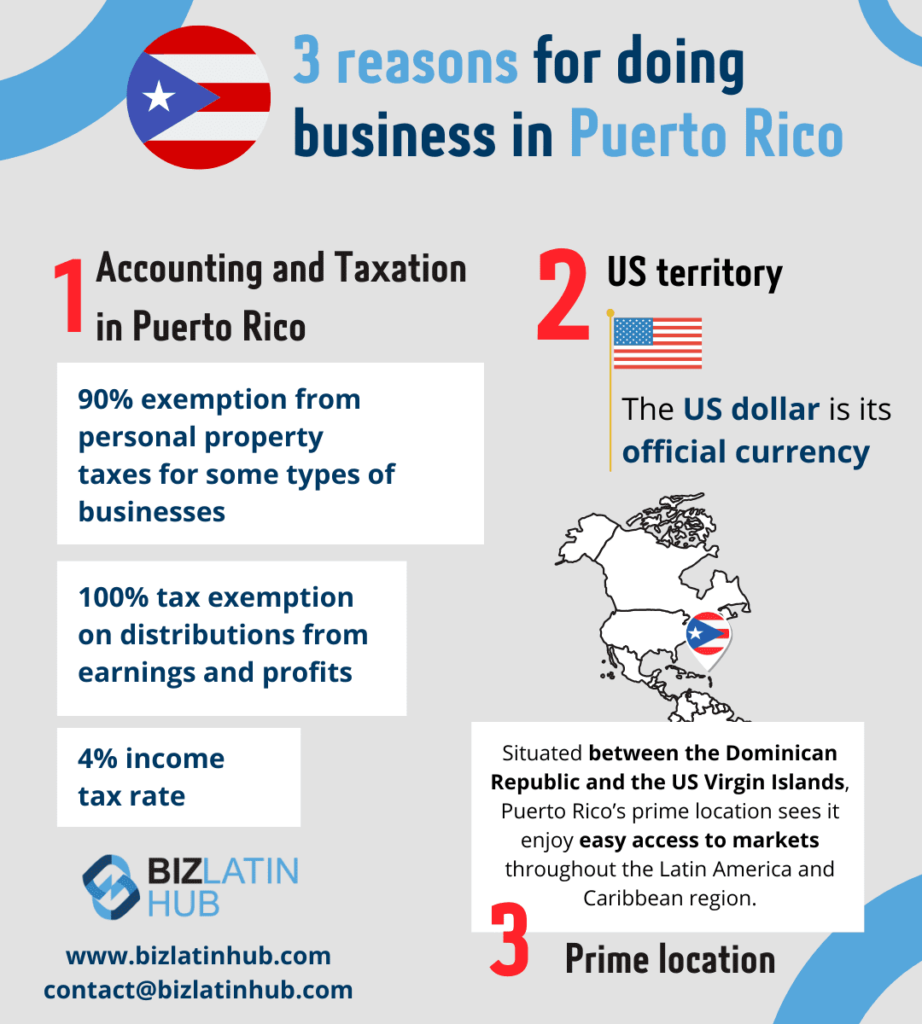

Located in the Caribbean Sea between the Dominican Republic and the US Virgin Islands, Puerto Rico has a population of around 3.2 million people and registered a gross domestic product (GDP) of $103.1 billion in 2020.

That represented a slight GDP decline compared to the previous year, owing to the turmoil caused by the COVID-19 pandemic. However, the Puerto Rican economy suffered relatively little compared to other economies in the region.

As such, Puerto Rico remains one of the most prosperous territories in Latin America and the Caribbean, registering a gross national income (GNI) $21,740 per capita in 2020 — a figure only exceeded in the region by the Bahamas.

Once a major producer of sugar, Puerto Rico now has a dynamic and diverse economy. Its well-developed manufacturing industry contributes more than 50% of total GDP and is a major draw for investors. Among the manufactured products representing key export goods to Puerto Rico are pharmaceuticals, medical equipment, garments, and computers.

Call centers are also a growing business activity because of the high level of English proficiency on the island. Puerto Rico is also home to a dynamic startup scene and an increasing pool of tech talent.

For investors looking to take advantage of these growing sectors and incorporate a business in Puerto Rico, the island has three free trade zones (FTZs) — known as foreign trade zones in the United States and its territories — that offer lucrative financial incentives to businesses located within their boundaries. Beyond the FTZs, the island also has a huge tourism sector that draws significant overseas investment.

Being a US territory, Puerto Rico uses the US dollar, which creates stability for locally-based business. The island also boasts considerably better infrastructure than many other nations in Latin America and the Caribbean.

Although a great deal of Puerto Rico’s trade is with the mainland United States, local businesses benefit from preferential access to a wide range of major global and regional markets, via US participation in a wide range of free trade agreements (FTAs).

There are many benefits for investors looking to start a business in Puerto Rico.

5 Steps to Incorporate a Business in Puerto Rico

You will need to follow these five key steps when you incorporate a business in Puerto Rico:

1. Reserve the name of the business you wish to incorporate in Puerto Rico

The first thing you must do when you incorporate a business in Puerto Rico is to reserve your company name. This entails entering potential names into official databases to ensure that they are not in use or too similar to companies already active in the market.

2. Appoint a legal representative

If you will be overseeing your Puerto Rican business interests from elsewhere, or are planning to be away from the territory for long stretches, you will need to appoint a legal representative. Once appointed via a power of attorney, they will be able to act on your behalf, including signing important official documents.

3. Establish the company bylaws

Once you have completed the two aforementioned steps, you will next need to draw up the company bylaws, which describe the activities, structure, objectives, and shareholders of the company.

4. Register the company

With the bylaws drawn up, you or your legal representative will be able to register the company before local authorities, including the Puerto Rico Chamber of Commerce.

5. Open a corporate bank account

The final step to incorporate a business in Puerto Rico is to open a corporate bank account, through which all transactions related to the company will pass through. Your legal representative will be able to offer you advice on the best providers based on your location and commercial activity.

Frequently Asked Questions when Forming a Company in Puerto Rico

Answers to some of the most common questions we get asked by our clients.

Yes, a business can be 100% foreign owned by either legal persons (“legal entities”) or natural persons (“individuals”).

Registering a company in Puerto Rico takes 4 weeks.

SRL in Puerto Rico stands for “Sociedad de Responsabilidad Limitada,” which translates to Limited Liability Company in English. This legal entity operates independently from its shareholders, offering them limited liability. SRL companies are prevalent due to their simplified requirements, making them a popular choice for business structures.

A “Domestic Corporation” in Puerto Rico refers to a company that is officially established and registered under the laws of Puerto Rico and operates within the territory of the island. In essence, it’s a corporation that is both legally incorporated in Puerto Rico and conducts its business activities exclusively within this region.

In Puerto Rico, the “S.R.L” (Sociedad de Responsabilidad Limitada) is the limited liability company.

A. Shareholders/Members: A corporation issues shares, while an LLC maintains percentage ownership. As a result, an LLC does not possess shareholders but rather members.

B. Annual Meetings: LLCs do not necessitate Annual Meetings unless stipulated within their Operating Agreement. Conversely, corporations invariably mandate an Annual Meeting.

C. Formal Requirements: Generally, an LLC entails fewer formalities and reporting obligations compared to corporations. Conversely, a Domestic Corporation typically entails more formalities, including the obligation to hold regular shareholder meetings and uphold specific corporate records.

D. Management and Governance: Within an LLC, members are empowered to directly oversee the business or designate managers. This flexible management structure can be tailored to the specifics of the operating agreement. Conversely, a Domestic Corporation is characterized by a more structured framework, involving a board of directors elected by shareholders. Significant decisions rest with the board, and officers are appointed under its authority.

Biz Latin Hub can help you incorporate a business in Puerto Rico

At Biz Latin Hub, our local team of corporate support professionals is on hand to assist you when you incorporate a business in Puerto Rico.

We offer a comprehensive portfolio of services, including company formation, accounting & taxation, legal services, visa processing, and hiring & PEO, meaning that we are able to assist with market entry and ongoing operations, and offer tailored packages of back-office support to suit every need.

With offices in 16 markets around Latin America and the Caribbean and trusted partners taking our coverage to almost every corner of the region, we also specialize in multi-jurisdiction market entry and ongoing support.

Contact us now to find out more about how we can support you doing business in Puerto Rico.

Or learn more about our team and expert authors.

The information provided here within should not be construed as formal guidance or advice. Please consult a professional for your specific situation. Information provided is for informative purposes only and may not capture all pertinent laws, standards, and best practices. The regulatory landscape is continually evolving; information mentioned may be outdated and/or could undergo changes. The interpretations presented are not official. Some sections are based on the interpretations or views of relevant authorities, but we cannot ensure that these perspectives will be supported in all professional settings.