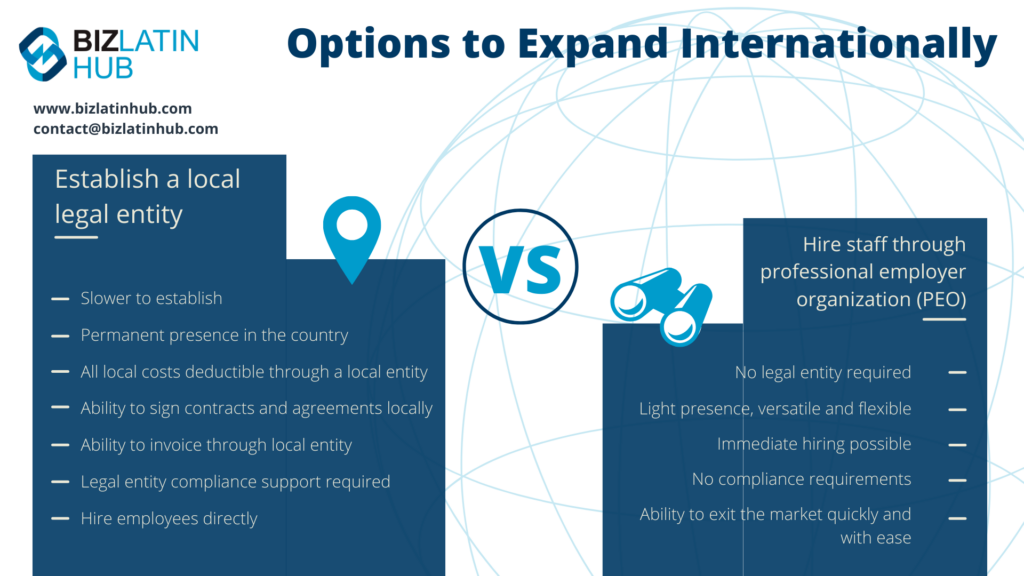

If you are interested in doing business in Puerto Rico, but are only planning a short-term or limited-scale operation, or would simply like to get to know the market better first, you may find that hiring staff via a professional employer organization (PEO) is your best option. Because when you take on employees through a PEO in Puerto Rico, you control their schedules and workloads, while handing the administrative burden over to the PEO firm.

For non-US investors, that is particularly appealing because it means you can get to work in the local market without having to go through company formation in Puerto Rico. A PEO in Puerto Rico may also be known as an employer of record (EOR).

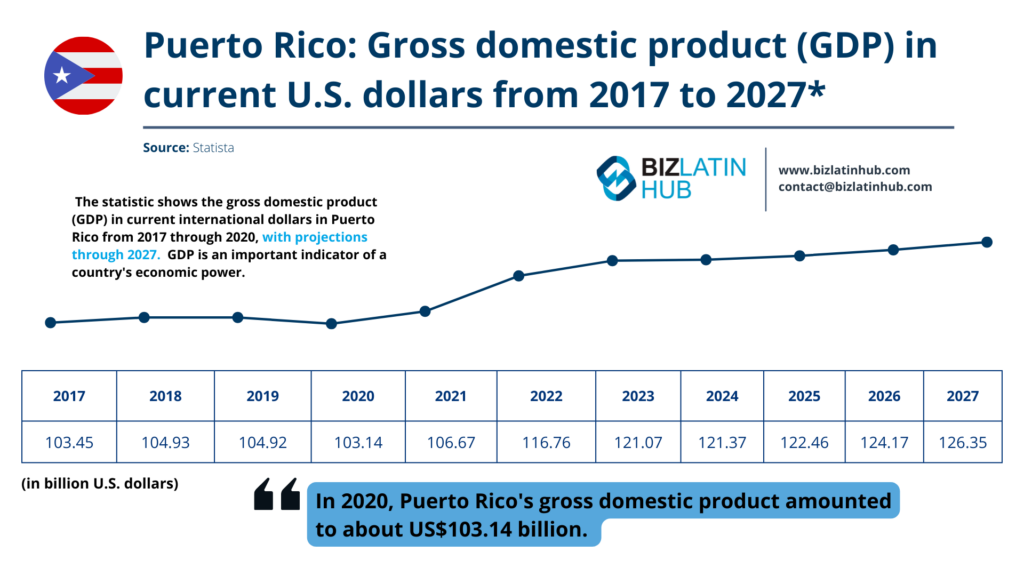

Situated in the Caribbean, between the Dominican Republic and US Virgin Islands, the US territory of Puerto Rico had a population of 3.82 million in 2021. That year, the island registered a gross domestic product (GDP) of $104.99 billion and a gross national income (GNI) of $21,970 — a prosperity marker higher than any mainland Latin American nation. This contributes to the high influx of foreign investment and market entry, creating high-demand for a PEO in Puerto Rico.

Puerto Rico has a highly industrialized economy, with industry contributing more than 50% of GDP in 2018, while the services sector accounted for slightly less. The agriculture sector generated less than 1% of GDP that year.

What is a PEO?

A PEO in Puerto Rico (Professional Employer Organization) is a third-party organization that provides comprehensive HR (Human Resources) services to businesses. PEOs act as co-employers, sharing employer responsibilities with the client company. They handle various HR functions, including payroll, benefits administration, employee onboarding and offboarding, compliance with employment laws, risk management, and other administrative tasks.

When a company partners with a PEO in Puerto Rico, they enter into a co-employment relationship. This means that the PEO takes on certain employment responsibilities, such as payroll processing and tax filing, while the client company retains control over day-to-day operations and retains ownership of the business.

One of the key advantages of partnering with a PEO is that it allows small and medium-sized businesses to access cost-effective HR services and expertise that they might not have in-house. PEOs often leverage their purchasing power to offer competitive employee benefits packages, which can help attract and retain talented employees. Additionally, a PEO in Puerto Rico can provide guidance on compliance with employment laws and regulations, which can be complex and time-consuming for businesses to navigate on their own.

In summary, a PEO is a professional organization that helps businesses outsource and streamline their HR functions, enabling them to focus on their core operations while ensuring compliance and providing comprehensive HR support.

That means the country has a ready supply of manufacturing workers, while it is also home to a growing startup sector, providing skilled workers for the tech industry.

Puerto Rico has seen growing interest among international investors over recent years, with foreign direct investment (FDI) rising over recent years, especially from the likes of Canada, Germany, Mexico, and Spain. Sectors that particularly attract investment include telecommunications, IT and tech services, and manufacturing.

If you are interested in doing business in the Puerto Rican market, read on to understand the benefits of using a PEO in Puerto Rico, as well as some of the legal requirements your PEO firm will assume responsibility for. Or go ahead and contact us now to discuss your business needs.

Table of Contents

How to use a payroll calculator

If you are keen to get an idea of the possible costs involved in payroll outsourcing in Puerto Rico, using a payroll calculator is one way to get a very good estimate.

Because while a payroll calculator won’t be completely accurate, it will give you the opportunity to search according to the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, based on that which is most convenient to you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Puerto Rico would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

Benefits of using a PEO in Puerto Rico

Hiring through a PEO in Puerto Rico offers various benefits:

- Cost savings: The fees you pay the PEO firm are typically much lower than the expenses involved in forming a company, hiring staff, and managing payroll and compliance obligations.

- Time efficiency: With a PEO in Puerto Rico, you can quickly find suitable candidates and hire them without the need to establish a legal entity. It takes only a few days after signing the services agreement.

- Market expertise: Hiring through a PEO in Puerto Rico provides access to local knowledge and a better understanding of the market, regulatory requirements, and business culture. This allows you to make informed decisions before making a deeper commitment.

One of the advantages of hiring through a PEO in Puerto Rico is the limited commitment it entails. This means that if you choose to discontinue operations, you can swiftly exit the market by offboarding outsourced employees, without the need for company liquidation.

Additionally, your PEO in Puerto Rico will have an established recruitment network to assist in finding suitable staff. Moreover, they will have strong connections within the local business community, which can provide additional benefits to your business.

By signing a service agreement with a PEO in Puerto Rico, you can enjoy the guarantee of compliance with all local regulations and norms. This ensures that your business remains in good standing with local authorities, giving you peace of mind.

Legal requirements a professional employer organization will assume

As part of the guaranteed compliance that your PEO in Puerto Rico will provide, some of the legal requirements it will take care of include:

- Drawing up and registering signed employee contracts

- Managing all aspects of payroll, including paying salaries in a timely manner

- Adhering to standard daily and weekly working hours as agreed

- Honoring of all national holidays celebrated in Puerto Rico

- Honoring sick and other personal leave entitlements

- Meeting statutory employee and employer contributions for social security

Common FAQs when hiring through an Employer of Record (EOR) in Puerto Rico

Based on our experience these are the common questions and doubts of our clients.

You can hire an employee by incorporating your own legal entity in Puerto Rico, and then using your own entity to hire employees or you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in Puerto Rico by acting as the legal employer. Meaning you do not need a Puerto Rican legal entity to hire local employees.

A standard employment contract in Puerto Rico should be written in Spanish (and can also be in English) and outline the terms and conditions of employment to establish a clear understanding between the employer and the employee. Some elements that are typically included in a standard employment contract in Puerto Rico are:

-Parties to the Contract

-Position and Responsibilities

-Employment Status:

-Work Schedule

-Compensation

-Benefits

-Probationary Period

-Termination Clause

-Confidentiality and Non-Compete Clause

-Intellectual Property

-Code of Conduct and Policies

-Governing Law and Jurisdiction

The mandatory employment benefits in Puerto Rico are the following:

-Paid Time Off (PTO)

-Meal and Rest Breaks

-Workers’ Compensation

-Unemployment Benefits

-Disability Benefits

-Parental and Maternity Leave

The total cost for an employer to hire an employee in Puerto Rico can vary based on the salary; however, indicatively the employer cost for mandatory employment benefits is 12.2% over the employee’s salary approximately, which is additional to the employee’s gross salary.

Please use our Payroll Calculator to calculate employment costs.

Biz Latin Hub can be your PEO in Puerto Rico

At Biz Latin Hub, we can provide the high-quality hiring & PEO services you need to find the right staff and get to work in Puerto Rico in the shortest time possible. With our comprehensive portfolio of back-office solutions, including legal, accounting, and company formation services, we can be your single point of contact for entering the market and operating in Puerto Rico, or any of the 17 countries around Latin America and the Caribbean where we have local teams in place.

Contact us now for personalized assistance or a free quote.

Learn more about our team of expert authors.

The information provided here within should not be construed as formal guidance or advice. Please consult a professional for your specific situation. Information provided is for informative purposes only and may not capture all pertinent laws, standards, and best practices. The regulatory landscape is continually evolving; information mentioned may be outdated and/or could undergo changes. The interpretations presented are not official. Some sections are based on the interpretations or views of relevant authorities, but we cannot ensure that these perspectives will be supported in all professional settings.