Finding the right personnel is crucial for any organization, as it can significantly impact its success. This is especially true when entering a new market like Paraguay. For companies with a limited-scale or short-term operation, partnering with a reliable Professional Employer Organization (PEO) or payroll company in Paraguay can provide the necessary confidence in hiring new employees and save valuable time on HR-related tasks.

Table of Contents

PEO / EOR Payroll Company in Paraguay

A PEO payroll company in Paraguay, also known as an Employer of Record (EOR) or a payroll outsourcing company, offers essential services for businesses expanding into Paraguay.

According to Paraguay’s Minister of Economy and Finance, Carlos Valdovinos, in response to the challenges posed by the COVID-19 pandemic, Paraguay has sought to attract foreign investment through low tax rates and laws that guarantee tax exemptions to companies settling in the country. Additionally, Valdovinos has emphasized improvements in migration processes, facilitating the acquisition of Paraguayan residency for investors. However, these processes can be time-consuming, making hiring a PEO payroll company in Paraguay a practical solution.

Paraguay, often referred to as “the heart of South America,” has experienced consistent growth in recent years and is actively working to create an investment-friendly environment. Free trade zones, including Zona Franca Internacional and Zona Franca Global del Paraguay in Ciudad del Este, offer attractive tax incentives.

The country maintains strong trade ties with major Latin American economies such as Brazil and Argentina, contributing to its robust and growing economy. In 2022, Paraguay’s GDP reached 41.7 billion (USD). The nation has also attracted significant foreign direct investment, totaling $207,095,460 in the same year. In 2022 the country has had 0% inflation.

If you are considering doing business in Paraguay, read on to discover how a PEO payroll company in Paraguay can assist in recruiting qualified personnel, ensuring the success of your commercial operations in this vibrant country.

PEO / EOR payroll company in Paraguay: what does it mean?

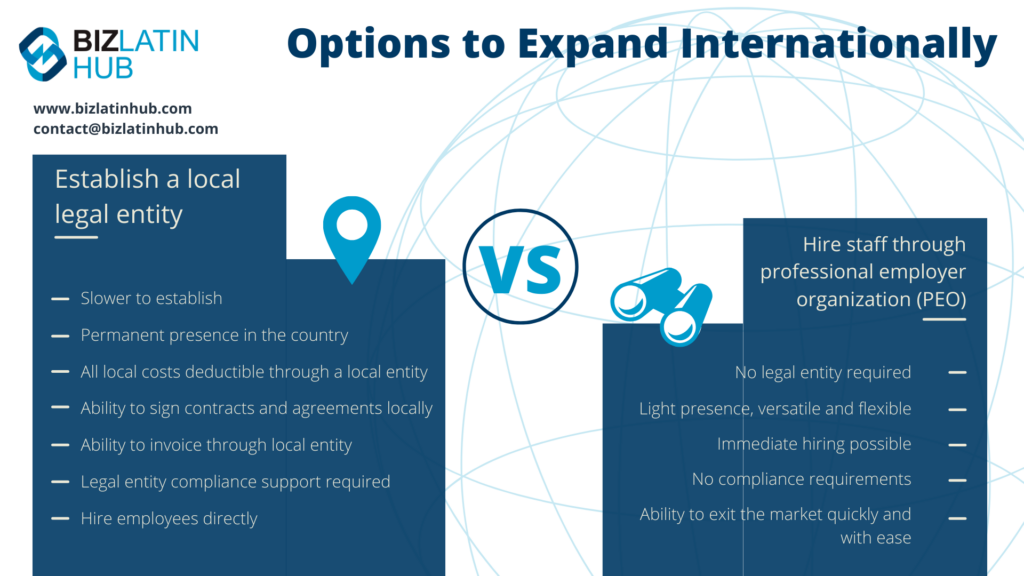

A PEO payroll company in Paraguay is capable of handling various HR tasks, such as recruitment, hiring, benefits, and payroll management. It acts as the official employer, allowing you to hire without forming a separate legal entity.

With extensive knowledge of local labor and tax regulations, a PEO payroll company ensures compliance with Paraguayan authorities and streamlines administrative processes, freeing your time for core business activities.

The payroll company also handles compensation for resignations, retirements, accrued vacations, and other required payments.

How to use a payroll calculator

If you are keen to get an idea of the possible costs involved in payroll outsourcing in Paraguay, using a payroll calculator is one way to get a very good estimate.

Because while a payroll calculator won’t be completely accurate, it will give you the opportunity to search according to the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, based on that which is most convenient to you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Paraguay would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

What are the main advantages of hiring staff through a PEO / EOR?

A PEO payroll company in Paraguay will also share the responsibility for the safety and health of the employees in the work environment and will carry out the procedures and updates required before Paraguay’s Ministry of Labor. Some of the main advantages of hiring staff through a PEO payroll company in Paraguay include:

Profitability: Employing local personnel through a PEO / EOR helps save costs and avoids additional expenses.

Risk Management: A PEO / EOR ensures full compliance with local regulations and protects your organization’s interests in legal matters.

Time-Saving: Outsourcing payroll and HR tasks allows you to focus on critical aspects of your business while benefiting from PEO / EOR assistance.

Employee recruitment: A PEO payroll company in Paraguay can efficiently perform recruitment processes to identify and hire the most suitable and qualified personnel to maximize your company’s possibility of success.

Legal advice: A PEO firm will provide legal advice on labor, tax, and civil legislation in case you require it.

Get to know the market: When you hire staff through a PEO payroll company in Paraguay, you have the opportunity to gain a better understanding of the market before considering a larger-scale expansion. The PEO payroll company can hire staff on your behalf in just a few days and make it easy to exit the market. This gives you the opportunity to evaluate whether your future business plans require deeper involvement, such as company formation or branch registration.

Common FAQs when hiring through an Employer of Record (EOR) in Paraguay

Based on our experience these are the common questions and doubts of our clients.

You can hire an employee by incorporating your own legal entity in Paraguay and then using your own entity to hire employees or you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in Paraguay by acting as the legal employer. Meaning you do not need a Paraguayan legal entity to hire local employees.

A standard Paraguayan employment contract should be written in Spanish (and can also be in English) and contain the following information:

-ID and address of the employer and employee

-City and date

-The location where the service will be provided.

-Type of tasks to be carried out

-Remuneration and bonifications/commissions (if applicable)

-Method payment frequency

-Duration of the contract.

-Probation period

-Work hours

-Additional benefits (if applicable)

The mandatory employment benefits in Paraguay are the following:

-Working tools necessary to carry out the work (if applicable)

-Payment of social security contributions (health, pension, and labor risks).

-Social benefits (service premium, severance pay, and interest on severance pay).

-Paid time-off (vacation and Sunday rest).

-Disabilities (common or labor origin).

-Transportation allowance (if applicable)

-Overtime and surcharges (if applicable)

For more information on mandatory employment benefits read our recent article on Employment laws in Paraguay.

The total cost for an employer to hire an employee in Paraguay can vary based on the salary structure. This is because the employer is responsible for covering 16.5% of the social security contributions, and the employee’s salary is subject to a 9.5% retention for social security purposes. The specific amount will depend on the employee’s earnings and work hours.

Please use our Payroll Calculator to calculate employment costs.

Biz Latin Hub can be your PEO / EOR payroll company in Paraguay

At Biz Latin Hub, our multilingual recruitment and employment experts have broad experience helping foreign companies get established in Paraguay, as well as elsewhere in Latin America and the Caribbean. With our full portfolio of legal, accounting, and back-office services, we can be your single point of contact to help you enter the Paraguayan market in the shortest possible time.

Contact us now to discuss your expansion options.

Learn more about our team and expert authors.

The information provided here within should not be construed as formal guidance or advice. Please consult a professional for your specific situation. Information provided is for informative purposes only and may not capture all pertinent laws, standards, and best practices. The regulatory landscape is continually evolving; information mentioned may be outdated and/or could undergo changes. The interpretations presented are not official. Some sections are based on the interpretations or views of relevant authorities, but we cannot ensure that these perspectives will be supported in all professional settings.