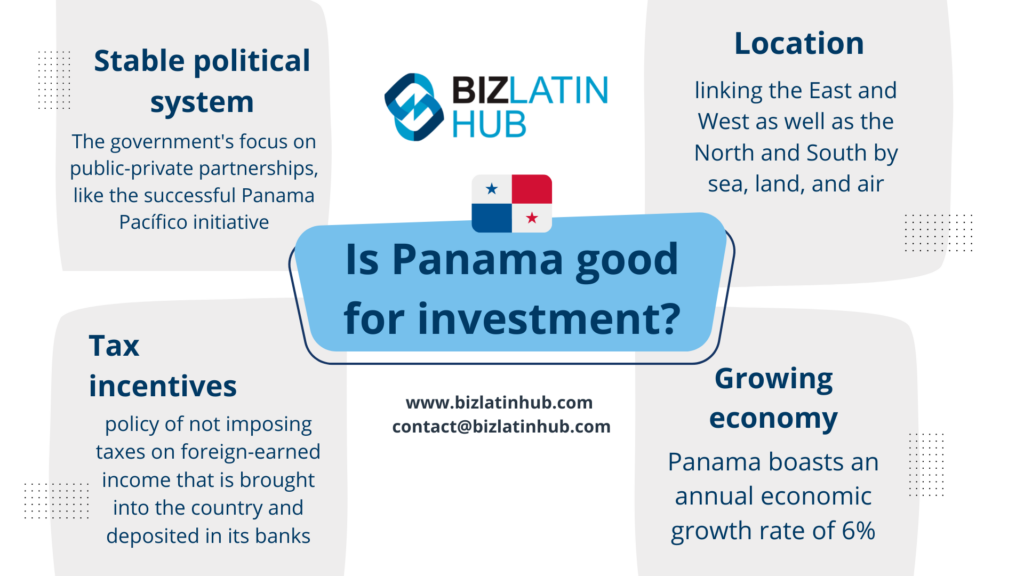

Being one of the fastest growing economies in Latin America, Panama provides the perfect mixture of conditions for an investor to the advantage of.

The excellent performance during the 2009 global financial crisis and consistent and stable economic growth have positioned Panama as a regional Latin American leader. As a result, investor confidence has surged, with small, medium and large companies looking to Panama as an attractive commercial jurisdiction.

Additionally, Panama has grown as one of the great locations to form and incorporate companies as a means of protecting wealth and assets from the government or from creditors.

Table of Contents

Can I Open a Corporate/Company Bank Account in Panama From Abroad?

It is well known that in order to set up a business you’ll need a corporate bank account and Panama is no exception; however, the bank account opening process is not as difficult as you may think.

Step 1: Work with a Local Partner in Panama

Law firms or consultants will be your best options as ‘partners’ to work with in order to begin the bank opening process. Despite the limited complexity of opening a bank account in Panama, there are some factors that need to be taken into account, such as language and cultural barriers; for this reason, it is important to work with a local partner who can provide support throughout the entire process.

Step 2: Match your Business Needs with a Suitable Panama Bank

Depending on the company’s activities, some banks are more flexible than others in regards to the opening of investment accounts, flexible payment methods, international transfers, etc. Make sure the bank you choose best fits your business needs and requirements.

Step 3: Banking Documentation in Panama

Banks in Panama need proof that you are eligible to open a bank account (both personal and corporate accounts). Requirements for opening a bank accounting in Panama are relatively straightforward; filling out paperwork and presenting documentation (i.e valid passport, financial statements, bank and commercial references). In Panama, all documentation must be apostilled in order to complete the bank account opening process.

Once all documentation is checked and approved, the bank will send a notification of the account opening.

Common Questions when opening a corporate bank account in Panama?

Based on our extensive experience these are the common questions and doubts from our clients when looking to open a company bank account in Panama.

No. However, you can open a bank account from abroad with the support of a local attorney empowered through a power of attorney (POA), however, the original bank application forms will need to be sent to Panama.

The following documents are required to open the company bank account:

– Copy of the articles of incorporation of the company;

– Certificate of the good standing of the company;

– Commercial license (where applicable)

– Bank reference letter, If the company doesn’t have a bank reference letter, the shareholders of the company will need to provide it;

– Evidence of income can be proven through a copy of the income tax declaration of the shareholders. Passport copy of all shareholders and members of the company.

Any member of the company that is authorized by company shareholders can have access to the bank account.

We recommend the following banks for foreign companies: Banco Aliado, Credicorp Bank, or Banistmo.

Companies choose to open bank accounts in Panama due to economic and political stability; the ability to hold currency in US Dollars, the territorial taxation system, and banking privacy.

Yes, law N° 23 of April 27th, 2015 which regulates money laundering prevention measures

states that the information obtained by a Financial entity and the Unit of Financial Analysis must be kept strictly confidential and may only be provided to third parties by order of the competent judicial authority.

Where Can You Find More Information About Opening a Corporate/Company Bank Account in Panama?

If you’re interested in finding out how you can open a bank account in Panama, and how to ensure that you work with a bank that can meet your business requirements, get in touch with one of our local experts at Biz Latin Hub. We have extensive experience in assisting foreign individuals and companies to do business in Panama and Latin America. Our professional and experienced legal team can provide support you with all your commercial requirements. Please contact us and see how we can be of assistance.

Offshore companies are used as an efficient business structure for both wealth management and asset protection. Watch this video and learn more.

The information provided here within should not be construed as formal guidance or advice. Please consult a professional for your specific situation. Information provided is for informative purposes only and may not capture all pertinent laws, standards, and best practices. The regulatory landscape is continually evolving; information mentioned may be outdated and/or could undergo changes. The interpretations presented are not official. Some sections are based on the interpretations or views of relevant authorities, but we cannot ensure that these perspectives will be supported in all professional settings.