Doing business in Honduras is an increasingly attractive prospect, thanks to consistent growth over decades, an improving security situation, and good business opportunities. There is no other country in Latin America where you can set up a company faster than in Honduras, which makes the Central American country an appealing option for those seeking to incorporate a country in the region.

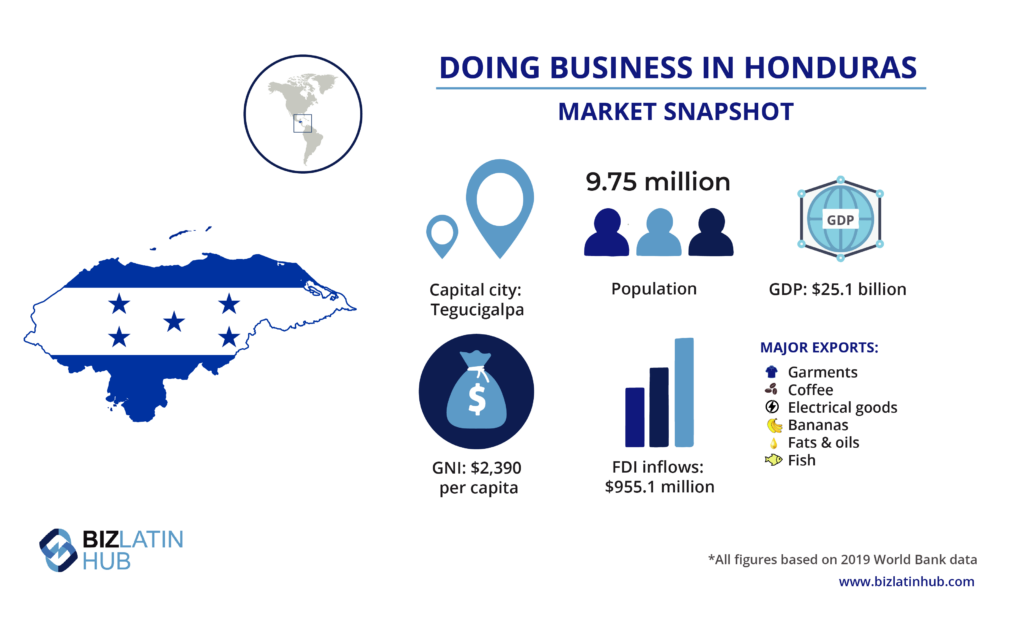

Bordered by El Salvador, Guatemala, and Nicaragua, Honduras has a well-developed agricultural sector, a growing industrial base, and an evolving professional services sector. The country’s major export products are bananas, coffee, fish, garments, and electrical goods.

Over recent years, the country has experienced the second-highest growth rate in Central America, exceeded only by Panama, and according to The World Bank, Honduras is expected to see growth accelerate in the coming years.

After a quarter of a century of almost unfettered gross domestic product (GDP) growth, Honduras registered a GDP of $25.1 billion in 2019, while gross national income (GNI) — a key marker of prosperity — rose to $2,390 per capita that same year (all figures in USD).

The country is party to a number of free trade agreements (FTAs), both via agreements struck by Central American countries collectively and through bilateral treaties. The agreements provide businesses based in Honduras with preferential access to Canada, Mexico, Peru, South Korea, the United States, the United Kingdom, and the European Union.

Although Honduras has seen fluctuations in foreign direct investment (FDI) inflows in recent years, since 1998 they have followed a general upward trajectory, increasing 14-fold between 1998 and 2018. In the following year FDI inflows dropped, but more than $955 million entered the country in 2019.

If you are interested in forming a company in Honduras, read on to learn about the legal entities to choose from, and the steps in the incorporation process. Or go ahead and contact us now to discuss your business options.

Table of Contents

Company formation in Honduras: which type to choose?

In Honduras, there are four main legal entities you can choose from when incorporating a company: proprietorship, partnership, a private limited liability company (LLC), or a public liability company (PLC).

Each entity has its own advantages and prerequisites. A proprietorship is the easiest to set up, but it carries unlimited liabilities and the owner is fully responsible for company debts and assets. A partnership is a similar arrangement, differentiated by the fact that liability is spread among the entity’s named partners.

An LLC can be fully foreign-owned and must have between 2 and 20 shareholders, whose liability will be equivalent to how much they contributed to the company. Setting up an LLC requires a low minimum share capital of $250 and the appointment of one manager who can be one of the contributing partners.

Alternatively, a PLC requires the appointment of two directors and company ownership divided into shares, which are publicly traded on a stock exchange.

A 6-step Guide for Company Formation in Honduras

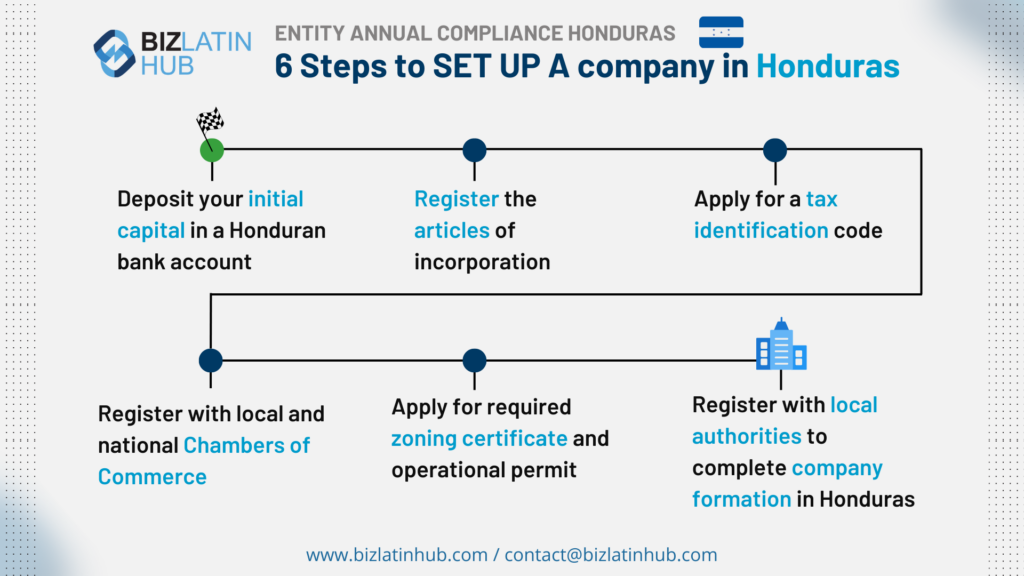

While steps and requirements can vary based on the type of entity you choose to set up, the following guide indicates key steps in the process of company formation in Honduras:

1. Deposit your initial capital in a Honduran bank account

The first step towards company formation in Honduras is depositing your initial capital in a local bank. You may find that a particular bank is recommended based on the type of business, geographic location, or sector you will operate in.

2. Register the articles of incorporation

Using a notary, you will then need to prepare and register the articles of incorporation with the Chamber of Commerce, which must include your company name, its registered address, and a description of the company structure and purpose. This process will usually take a week.

3. Apply for a tax identification code

After registering the articles of incorporation, you will need to apply for a tax identification code (TIN), which will be used to identify the company on tax declarations, invoices, and other official financial documentation. This process usually takes no longer than a single business day.

4. Register with local and national Chambers of Commerce

The next step for company formation in Honduras involves registering the entity at the Chamber of Commerce, which will carry a fee based on the initial share capital. The maximum fee applicable is 3,000 lempiras (approximately $125 as of May 2021).

5. Apply for required zoning certificate and operational permit

The process of company formation in Honduras requires acquiring both a zoning certificate and an operational permit. The former will establish the location of the business activities, confirming that it is permitted to operate in that location, while the latter will confirm that the company is permitted to undertake particular activities.

6. Register with local authorities to complete company formation in Honduras

To complete the company formation process, your company will have to be registered with the Ministry of Finance’s Revenue Administration Service (SAR), the Social Security Institute (IHSS), the professional training institute (INFOP) and the Social Housing Fund (FOSOVI). Contributions to the IHSS total 5% of each employee’s salary, while the INFOP and FOSOVI receive 1% and 1.5% respectively.

Common FAQs when Forming a Company in Honduras

Answers to some of the most common questions we get asked by our clients.

Yes, a business can be 100% foreign owned by either legal persons (“legal entities”) or natural persons (“individuals”).

Registering a company in Honduras takes 4 weeks

The S.A. in a company name in Honduras refers to a “Sociedad Anónima,” which translates to a “Joint Stock Company.” This legal framework establishes the company as a separate entity from its shareholders, with each shareholder possessing shares that represent their ownership stake. Importantly, the financial responsibility of shareholders is confined solely to the value of their shares, crafting a safeguarded boundary. The S.A. structure holds substantial prominence in Honduras due to its exceptional adaptability and flexibility, rendering it the favored option for a diverse range of business ventures.

SRL in Honduras, stands for “Sociedad de Responsabilidad Limitada,” which translates to Limited Liability Company in English. This legal entity operates independently from its shareholders, offering them limited liability. SRL companies are prevalent due to their simplified requirements, making them a popular choice for business structures.

In Honduras, both “S.A” (Sociedad Anónima) and “S.R.L” (Sociedad de Responsabilidad Limitada) are limited liability entity types.

A: Shareholders: An S.R.L. can have one to twenty-five shareholders, while an S.A. must have at least five shareholders.

B: Administration: An S.R.L. has no board of directors, only appointed managers; an S.A. requires a board with at least one member and a comptroller.

C: Liability: In both entities, shareholders are jointly liable for debts up to their contributions.

D: Transfer of shares: In an S.R.L. share transfers require approval from other shareholders, while S.A. shares can be transferred without approval through a public deed.

E: Company Size: An S.R.L. is ideal for smaller companies or those with shareholders outside of Honduras, while S.A. suits larger companies.

F: Regulatory requirements: An S.R.L. faces easier regulations compared to S.A., with fewer formalization requirements.

Biz Latin Hub can Help you with Company Formation in Honduras

At Biz Latin Hub, our multilingual team of company formation specialists is equipped to help you quickly enter the Honduran market and take advantage of the business opportunities available. With our complete portfolio of back office support options, including legal, accounting, hiring, and commercial representation services, we can be your single point of contact for forming a business in Honduras, or any of the other 17 countries in Latin America and the Caribbean where we operate.

Reach to us now for personalized assistance or a free quote.

Learn more about our team and expert authors.

The information provided here within should not be construed as formal guidance or advice. Please consult a professional for your specific situation. Information provided is for informative purposes only and may not capture all pertinent laws, standards, and best practices. The regulatory landscape is continually evolving; information mentioned may be outdated and/or could undergo changes. The interpretations presented are not official. Some sections are based on the interpretations or views of relevant authorities, but we cannot ensure that these perspectives will be supported in all professional settings.