Incorporating a company in Colombia involves several steps, but the process is not complicated. This article will outline how to register a company in Colombia.

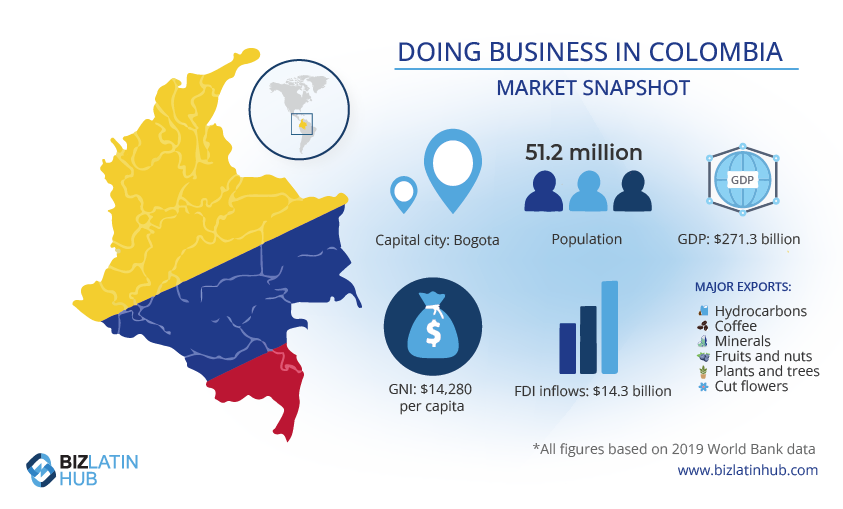

When planning to expand your business operations in Latin America, Colombia is a compelling choice. In 2016, The Economist named Colombia the Country of The Year. That year, Colombia had foreign direct investment (FDI) of USD 13.5 billion, a 15.8% increase from the previous year. Fast forward to 2023: FDI has continued to rise and is now USD 17.05 billion.

Colombia also boasts better investor protection than most other countries. In 2022, it was ranked higher than the US, Germany, and Israel. Learn more about how to incorporate a company in Colombia below.

Why choose Colombia to incorporate/form a company?

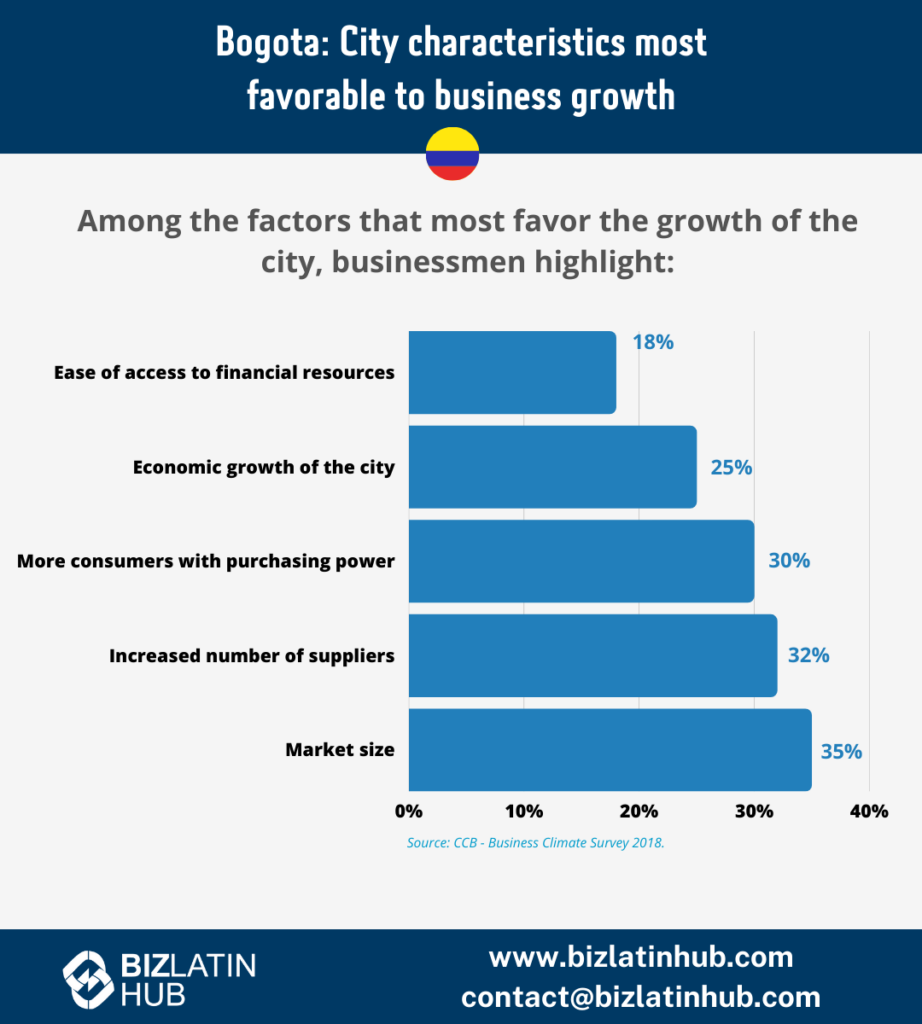

Before we dive into how to incorporate a company in Colombia, let’s review why Colombia is a great place to do business. The country has an array of advantages that businesses can capitalize on. Its strategic location in South America provides easy access to regional and international markets. Colombia has a rapidly growing economy that is a hotspot for innovation.

The substantial number of young and skilled workers leads to competitive labor costs. Colombia’s growing workforce is a big reason businesses have been looking to expand into the country. Colombia has made significant strides in improving its business climate through regulatory reforms that simplify bureaucratic processes and provide incentives for foreign investment. For example, the government offers tax incentives and has established free trade zones for foreign entrepreneurs to incentivize company incorporation.

Colombia boasts abundant natural resources, especially agriculture, mining, and renewable energy. The ongoing enhancements in infrastructure and transportation networks also streamline business operations. Additionally, the country’s diverse and growing consumer base makes Colombia a promising market for companies seeking growth in Latin America.

Table of Contents

What are the minimum requirements to incorporate a SAS in Colombia?

The minimum requirements to incorporate a SAS – Sociedad de Acciones Simplificada in Colombia are:

- Confirm the legal name of the entity.

- A minimum of (1) single shareholder, which can be either a natural (i.e. person) or legal person (i.e. entity.)

- Appoint a legal representative within the bylaws of the company.

- Confirm the business activities and corporate purpose of the company.

- A minimum capital of USD 400, should be transferred by the shareholder upon opening the bank account.

- Register a Fiscal Address within the country and use it for official correspondence.

Important Tip(s):

The founding shareholders do not need to physically travel to the country as the establishment can be completed via a power of attorney.

Based on experience, we would always recommend a minimum capital of USD$1,000 and should be commensurate with the type of business activities.

What do you need to get started with your company formation in Colombia?

To proceed with incorporating an SAS in Colombia, you will need to provide the following:

- A name for your legal entity.

- Shareholder identification documentation.

- Confirm the business activities and corporate purpose

- Minimum initial capital to be registered

Important Tip: We always recommend having a preferred legal name and two alternatives in case the primary legal name is unavailable.

Create, register, incorporate a company in Colombia

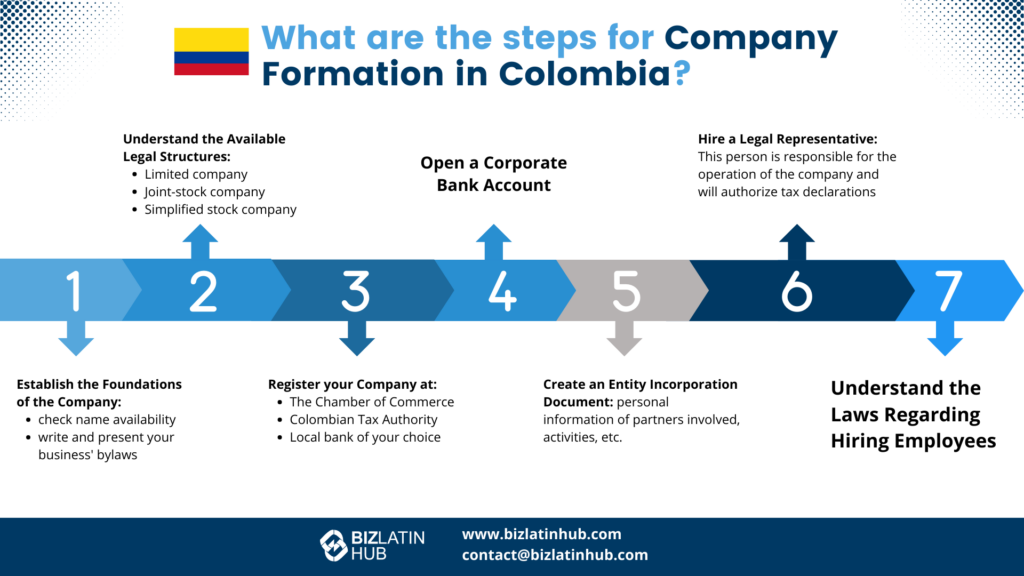

1. Establish the foundations of the company

To establish a company in Colombia, it’s essential to verify the availability of your chosen company name. Your legal business name and trademark can be different.

Be sure to write and present your business’ bylaws. This agreement should include all relevant information on your company, such as how it will function and the activities it will be involved with.

If you are establishing a company in Bogota, the full process of getting a Tax ID can be completed in the Chamber of Commerce. However, if you are going to be located in another city, additional steps will be needed. First, you must apply for a provisional Tax ID, and only after receiving it can you apply for the final Tax ID before DIAN. This is a crucial step.

2. New company formation: Understand the available legal structures

There are three legal structures a company can fall into in Colombia. You can choose the one that best suits your needs. They include:

- Limited company

- Joint-stock company

- Simplified stock company

A simplified stock company (SAS) is the simplest option for most foreign investors incorporating a company in Colombia because it requires fewer formalities. The law permitting the establishment of a SAS was passed in 2008, and it remains an ideal option for both local and foreign investors.

3. Register your company at public institutions to incorporate a company in Colombia

There are three primary institutions you will deal with when incorporating a company in Colombia. They include:

- The Chamber of Commerce

- Colombian Tax Authority

- Local bank of your choice

The Chamber of Commerce is responsible for regulating the creation of new companies in Colombia. It ensures that your registration adheres to the current legal structures and policies. It will also provide a certificate that demonstrates the existence and legal status of your company.

This certificate will be requested by most private and public entities existing in Colombia once you begin operating your business.

The Tax Authority registers your business into the tax system. This registration earns you a unique tax number (NIT), which will serve as a general identification and enable you to present the mandatory tax declarations.

Additionally, you’ll be required to establish a company bank account, which will serve both operational purposes and receiving foreign investments.

4. Open a corporate bank account

Opening a corporate bank account is a straightforward process. You will need to present the Existence Certificate from the Chamber of Commerce, the Tax ID certificate (RUT), the ID of the legal representative, and the opening balance sheet of the company.

Keep in mind that some banks have specific requirements for opening an account.

5. Create an entity incorporation document

You will need an incorporation document highlighting the names and personal information of all partners involved in the business. It should also indicate the name of the company and the activities it will be performing in Colombia.

Other things the incorporating document must include

- Capital structure

- The board of directors

- Partner responsibilities

- Causes of termination

6. Hire a legal representative to incorporate a company in Colombia

Your company must have a legal representative who can be different from the company owners. This person is responsible for company operations, authorizing tax declarations, and signing all contracts and legal documents.

7. Understand the laws regarding hiring employees

The final step in the process of incorporating a company in Colombia affects the hiring of employees. You must register your business with the Family Compensation Fund, the Colombian Family Institute, and the Governmental Learning Service, and fill out a unique form for all these agencies.

You will also need to register your employees for public health coverage. Employees have the right to choose their desired provider, to which your company has to submit the required form.

Your company must also affiliate itself with a pension system. You can register with the public fund or other private funds. However, you can’t choose the pension fund for your employees as they have the right to choose their preferred fund.

Registering your business with the Labor Risks Administrator is also essential. This agency helps in covering professional illness and workplace injury cases. You have to pay monthly contributions to the program and protection starts 24 hours after submitting the form.

Common FAQs when forming a company in Colombia

Answers to some of the most common questions we get asked by our clients.

Yes, a business can be 100% foreign-owned by either legal persons (“legal entities”) or natural persons (“individuals”).

Registering a company in Colombia takes four weeks.

LTDA in a company name in Colombia refers to a “Sociedad de Responsabilidad Limitada,” which refers to a Limited Liability Company. This type of corporate structure is characterized by the partners’ liability being limited to their contributions to the company’s capital. In an LTDA, partners are not personally responsible for the company’s debts beyond their investment, providing a level of protection for individual assets. Small to medium-sized businesses frequently use it in Colombia because it combines elements of partnership and corporate structures, providing flexibility and legal protections.

S.A.S means “Sociedad por acciones Simplificada”, which translates to “Joint Stock Company.” This is a type of commercial company with legal personality and assets independent from those of its owners. Shareholders are liable only up to the amount of their respective contributions corresponding to the integration of the shares they subscribe to or acquire. Shareholders are not liable for labor, tax, or any other type of obligations incurred by the company beyond its contribution, except if the legal personality of the company is declared unenforceable.

Both the Sociedad por Acciones Simplificada (S.A.S) and Sociedad de Responsabilidad Limitada are Limited Liability Companies in Colombia.

A.Incorporation: An SAS is established through an authenticated private document, while an LTDA is established through a public deed before a notary.

B.Number of shareholders: An SAS can have a single shareholder (up to an unlimited number), whereas an LTDA must be incorporated with a minimum of two shareholders and a maximum of 25 shareholders

C. Liability: In both types of companies, shareholders are liable only up to the amount of their respective capital contributions.

D. Capital: In a SAS, the capital is divided into shares of equal value, and the payment is not stipulated. In an LTDA, the capital is divided into equal-value portions (cuotas partes) and must be fully paid at the time of the company’s incorporation.

Get more information on how to incorporate/form a company in Colombia

Colombia is an attractive destination if you are looking to expand your business operations or start a new business. However, before you get everything up and running, you need to complete the company registration process.

Biz Latin Hub offers tailored business services, including company formation, legal services, accounting/taxation services, and visa processing. Contact us now and see how we can assist you in registering your new company in Colombia.

Watch the following video to learn more about the company formation process in Colombia.Learn more about our authors and team.

The information provided here within should not be construed as formal guidance or advice. Please consult a professional for your specific situation. Information provided is for informative purposes only and may not capture all pertinent laws, standards, and best practices. The regulatory landscape is continually evolving; information mentioned may be outdated and/or could undergo changes. The interpretations presented are not official. Some sections are based on the interpretations or views of relevant authorities, but we cannot ensure that these perspectives will be supported in all professional settings.