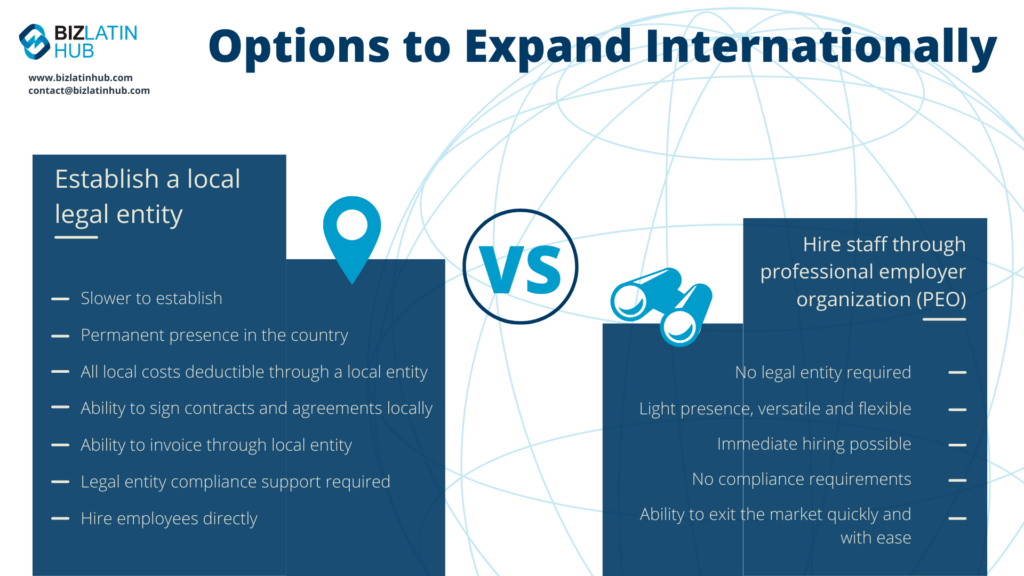

Engaging with a professional employer organization (PEO) when entering the Bolivian market could be the wisest decision if you have a smaller-scale or temporary operation, or are just looking to get your business moving in the shortest time possible.

As one of the fastest-growing economies in Latin America, Bolivia offers an unsaturated market with enormous potential for foreign companies looking to invest in sectors such as hydrocarbons, mining, natural resources exploitation, transport, and communication.

Having shown consistent growth in both gross domestic product (GDP) and gross national income (GNI) over recent years and with economic growth expected to bounce back in the future to levels similar to before the COVID-19 pandemic, the prospects for investment in Bolivia appear promising.

For anyone keen on entering the market without the need to incorporate a company or appoint a full legal representative in Bolivia, hiring local staff through a PEO could be the ideal solution.

Table of Contents

Why hire staff through a PEO in Bolivia?

Contracting the services of a PEO in Bolivia enables you to recruit, hire, or fire local staff without needing to formally establish a company in the country because the PEO firm will do it all on your behalf.

The PEO will have an established recruitment process based on the local market and can help you to manage time-consuming administrative activities tasks such as payroll management.

A PEO in Bolivia will also act as the registered employer before local authorities. However, it is important to note that the PEO client will still maintain the day-to-day relationship with employees, providing them with the relevant instructions for their daily work activities.

What are the main advantages of a PEO?

Some of the main advantages of hiring staff through a PEO in Bolivia include:

No need to set up a company or branch in Bolivia: If your company has a smaller-scale operation or will develop its activities for a short period of time, it will likely not be necessary to establish a company in the country. In this sense, a PEO will be in charge of recruiting, hiring, firing, and paying all taxes and benefits to local employees. This will leave you time to focus on other aspects of your business.

A PEO will request working permissions for foreign employees: A PEO in Bolivia will oversee any working visas or residency permits for foreign workers. Note that in Bolivia foreign workers can only represent 15 percent of the total payroll of a company.

A PEO will manage all payments for employees: A PEO in Bolivia will be responsible for payroll presentation, health insurance, pension fund, and tax payments related to employees.

A PEO will represent your company in Bolivia: Any claim related to the employees will be directed to the PEO in Bolivia that fully represents your business. A PEO has the necessary powers to resolve legal issues while offering a guarantee to the client that legal norms and labor law will be fully adhered to.

A PEO can provide legal counsel on labor law: A PEO is equipped to provide professional advice on matters related to employee hiring, constructive dismissal claims, and job compliance. This will avoid legal problems that can diminish the profitability of your business operations in the country.

Challenges of hiring through an Employer of Record in Bolivia

- Risk of Permanent Establishment (PE)

- Rising admin costs

- Cultural and communication obstacles

- Absence of employee control

- Difficulty growing company culture

Bolivia is currently undergoing significant political turmoil. As a result, your EOR must have a comprehensive understanding of these changes and their potential impact on your business.

The hiring process through an Employer of Record in Bolivia presents many issues. The following are five challenges associated with partnering with an EOR.

1. Risk of Permanent Establishment (PE)

While the EOR structure offers businesses a convenient and faster way to hire employees in a new location, it also carries the risk of inadvertently establishing a permanent establishment. This risk arises when the business is perceived to exert substantial control over the activities of its employees in the new location or maintains a significant presence in a foreign country. Therefore, it is crucial for businesses to thoroughly evaluate their EOR arrangement and ensure strict compliance with local laws and regulations.

2. Rising admin costs

When hiring a substantial number of employees, the expenses linked to the EOR structure can expand rapidly. For instance, the third-party EOR service provider may levy a premium for their services and impose additional costs for managing the benefits of a large workforce. By establishing a local entity, businesses can attain greater control over their workforce and potentially mitigate the expenses associated with the EOR structure.

3. Cultural and communication obstacles

Companies that need to become more familiar with the language and culture in Bolivia may experience problems—for example, communicating with employees and understanding local labor laws and regulations. Miscommunications, misunderstandings, and compliance issues are possible as a result.

4. Absence of employee control

Businesses that use EORs may have less ownership and control over their employees. Since the Employer of Record in Bolivia is the legal employer, the company may have less influence over hiring decisions or other employment-related matters.

5. Difficulty building company culture

When partnering with an EOR, businesses might encounter challenges in creating a unified company culture. As employees work remotely and are overseen by a third-party organization, fostering a feeling of shared objectives and connection among the workforce can be challenging.

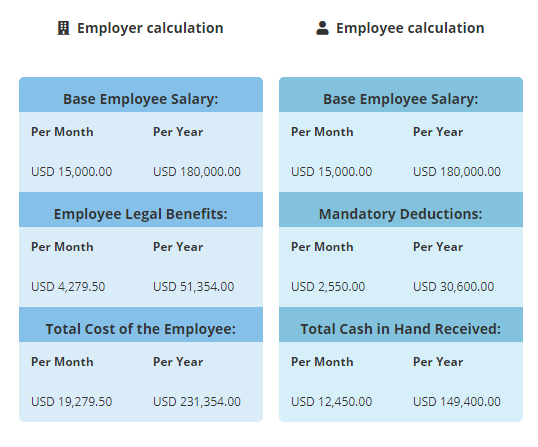

How to use a payroll calculator

If you are keen to get an idea of the possible costs involved in payroll outsourcing in Bolivia, using a payroll calculator is one way to get a very good estimate.

Because while a payroll calculator won’t be completely accurate, it will give you the opportunity to search according to the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, based on that which is most convenient to you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Bolivia would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

Common FAQs when hiring through an Employer of Record (EOR) in Bolivia

Based on our experience these are the common questions and doubts of our clients.

You can hire an employee by incorporating your own legal entity in Bolivia, and then using your own entity to hire employees or you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in Bolivia by acting as the legal employer. Meaning you do not need a Bolivian legal entity to hire local employees.

A standard Bolivian employment contract should be written in Spanish and contain the following information:

· ID and address of the employer and employee

· City and start date

· The location where the service will be provided.

· Job description

. Remuneration and benefits (if applicable)

· Method payment and frequency

· Probation period

· Specification of daily and weekly working hours.

· Beneficiaries’ ID numbers and type of relationship with the employee

· Confidentiality clause

The mandatory employment benefits in Bolivia are the following:

. Working tools necessary to carry out the work (if applicable)

· Payment of social security contributions (health, pension, and labor risks).

· Social benefits (severance pay, aguinaldo)

· Paid time-off (vacation and Sunday rest).

· Disabilities (common or labor origin).

· Overtime and surcharges (if applicable)

· Sick Leave, maternity, and paternity Leave

. Work-Related Accident and Occupational Disease Coverage

For more information on mandatory employment benefits read our recent article on Employment laws in Bolivia

The total cost for an employer to hire an employee in Bolivia can vary based on the salary; however, indicatively the employer cost for mandatory employment benefits is 16.71% percent of the gross employee salary and benefits.

Please use our Payroll Calculator to calculate employment costs.

Hire local staff in Bolivia with the help of Biz Latin Hub

At Biz Latin Hub, our team of multilingual recruitment and legal specialists has the expertise required to support employers hiring staff in Bolivia, and guarantee full compliance with labor regulations in the country. With our full suite of PEO services in Bolivia, as well as other countries across Latin America and the Caribbean, we are your single point of contact to solve all of your hiring and payroll needs.

Reach out to us now for more information on how we can help you throughout the recruitment and hiring process in Bolivia.

Learn more about our team and expert authors and watch the following video to know more about how to expand into Latin America through a PEO solution.

The information provided here within should not be construed as formal guidance or advice. Please consult a professional for your specific situation. Information provided is for informative purposes only and may not capture all pertinent laws, standards, and best practices. The regulatory landscape is continually evolving; information mentioned may be outdated and/or could undergo changes. The interpretations presented are not official. Some sections are based on the interpretations or views of relevant authorities, but we cannot ensure that these perspectives will be supported in all professional settings.