Understanding the different types of companies in the Dominican Republic is critical to knowing which suits your needs most ahead of incorporating a company in the Caribbean nation.

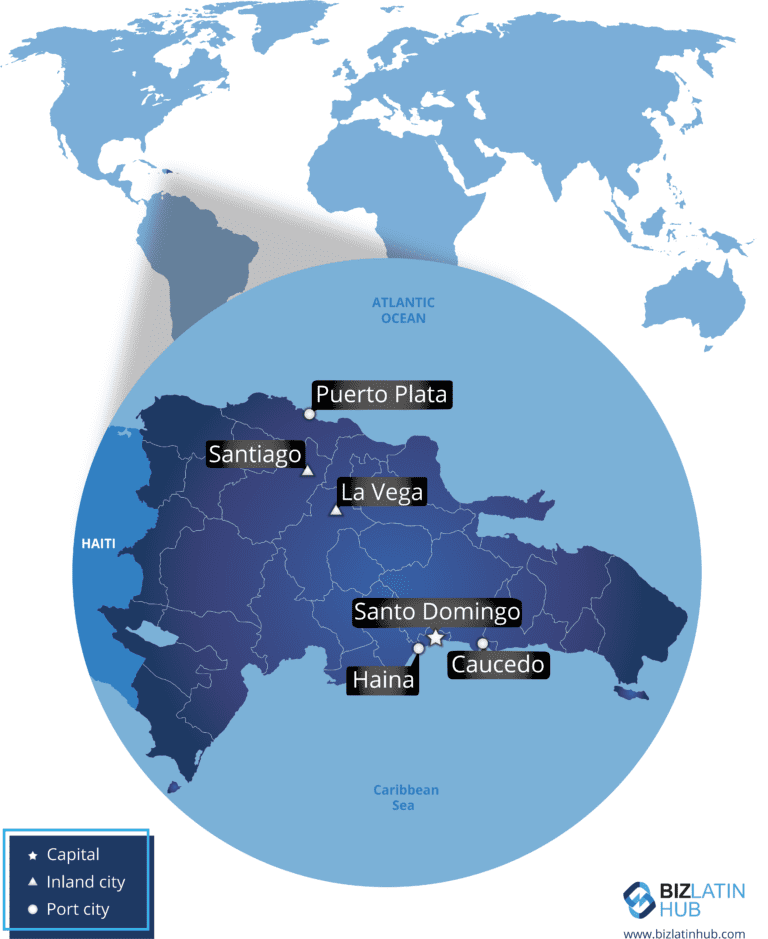

Market observers have recognized the Dominican Republic worldwide as one of the top travel destinations for tourists in the region. However, the island nation has a great deal to offer for business owners looking to enter the Caribbean.

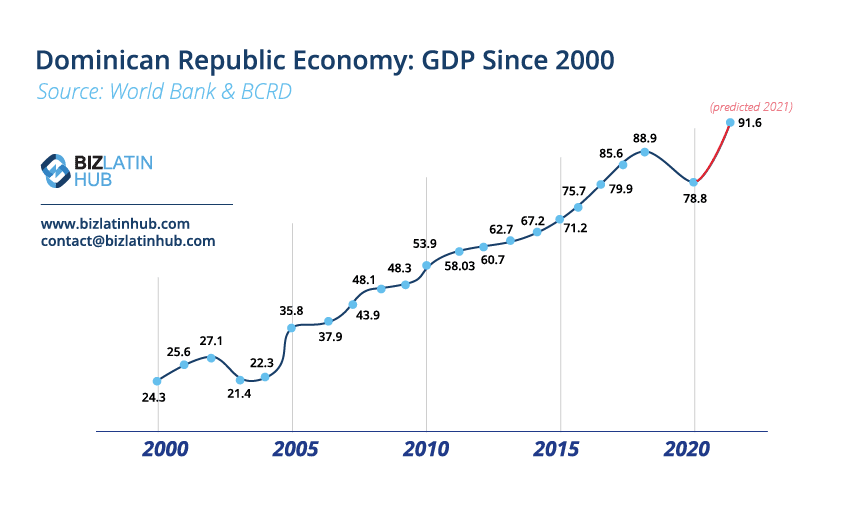

According to the World Bank, the Dominican Republic has the second-highest GDP figures in the Caribbean. In recent years, we have seen an important increase in foreign direct investment into the Dominican Republic.

This takes place specifically in the manufacturing, real estate, export, and tourism sectors. This region has also made a name for itself as an appealing hub for foreign businesses through its tax and migration offerings.

With our expertise in company formation in the region, we are able to provide key information about the different types of companies in the Dominican Republic.

Table of Contents

Understanding Types of Companies in the Dominican Republic

When looking to enter the Dominican Republic, foreign investors are confronted with a choice in terms of what sort of commercial presence they want to have. Expanding multinationals must incorporate a company in the Dominican Republic as a formal corporate vessel for business.

Branches and representative offices are viable options for multinational companies. However, choosing the best type of company must be done on a case-by-case basis.

Next review the different types of companies in the Dominican Republic for incorporation.

Limited Liability Company

The Limited Liability Company (Sociedad de Responsabilidad Limitada, or SRL in Spanish) is historically the popular choice for typically small businesses. It is quite appealing in the sense that the social capital required to incorporate the company in the Dominican Republic is quite reasonable and low.

This type of company requires a minimum of 2 shareholders which can be either individual persons or other legal entities. The shareholders can have a local or a foreign domicile.

In terms of administration, at least 1 director is required to manage the SRL legal entity.

Regarding tax compliance, it is necessary for this type of company to file annual financial statements to tax authorities. Furthermore, the company’s account needs to undergo an annual audit.

Simplified Limited Company

The Simplified Limited Company is also known as Sociedad Anónima Simplificada or SAS in Spanish. It is the preferred legal entity for company incorporation in the Dominican Republic when one is looking to raise capital. It is easier to do so than for example in the previously explained SRL. In other words, this type of company in the Dominican Republic is quite appealing as well for entrepreneurs looking to be that next unicorn.

This type of company requires a minimum of 2 shareholders which can be both individuals or legal entities. The shareholders can have a local or a foreign domicile.

In terms of administration, at least 1 director is needed to manage the SAS legal entity.

All SAS companies require a higher initial company capital – approximately 3 times the amount – than that needed to incorporate an SRL.

Limited Company

The Limited Company is also known as the Sociedad Anónima or SA in Spanish. Typically, this corporate structure is best suited for larger-sized companies that will likely participate in the stock market, publicly offering their shares to investors.

This legal entity requires a minimum of 2 shareholders which can be both individuals and legal entities. The shareholders may have a local or a foreign domicile.

The Limited Company legal entity requires a minimum of 3 directors to take care of the administration and governance of the company.

Branch

As is the case with Limited Companies in the Dominican Republic, Branches are an excellent option for larger foreign multinational companies. This option has benefits in terms of reputation, banking, and engaging with third parties. It is also a preferable choice if the intent is to engage with local public entities directly or via tenders.

A Branch in the Dominican Republic needs to have in place at least 1 individual (national or foreign) to act as its representative in the country.

Find the right type of company in the Dominican Republic for your business

Company incorporation in the Dominican Republic market brings business many advantages. However, finding the right legal entity in another country can be very challenging.

Our multilingual team from Biz Latin Hub has vast experience in Latin America and the Caribbean Region. Our local lawyers and professional accountants provide you with tailor-made business solutions. We offer a wide range of market entry and back-office services, such as company incorporation and other legal services, due diligence, visa procedures, PEO and hiring support, payroll management, accounting and taxation, and more.

Get in touch with our specialists to start your business in the Dominican Republic soon!

Learn more about our team and expert authors.

The information provided here within should not be construed as formal guidance or advice. Please consult a professional for your specific situation. Information provided is for informative purposes only and may not capture all pertinent laws, standards, and best practices. The regulatory landscape is continually evolving; information mentioned may be outdated and/or could undergo changes. The interpretations presented are not official. Some sections are based on the interpretations or views of relevant authorities, but we cannot ensure that these perspectives will be supported in all professional settings.