If you are interested in doing business in Guyana, you may want to consider the possibility of hiring staff through a professional employer organization (PEO). Because when you hire through a PEO in Guyana, you can get a local workforce without having to establish a legal entity, meaning your market entry is completed in only the time it takes to find your ideal staff.

For investors planning a short-term or limited-scale market entry, or who simply wish to get more familiar with the market before making a deeper commitment, hiring through a PEO firm in Guyana can therefore be an attractive option. A PEO can also be known as an employer of record (EOR).

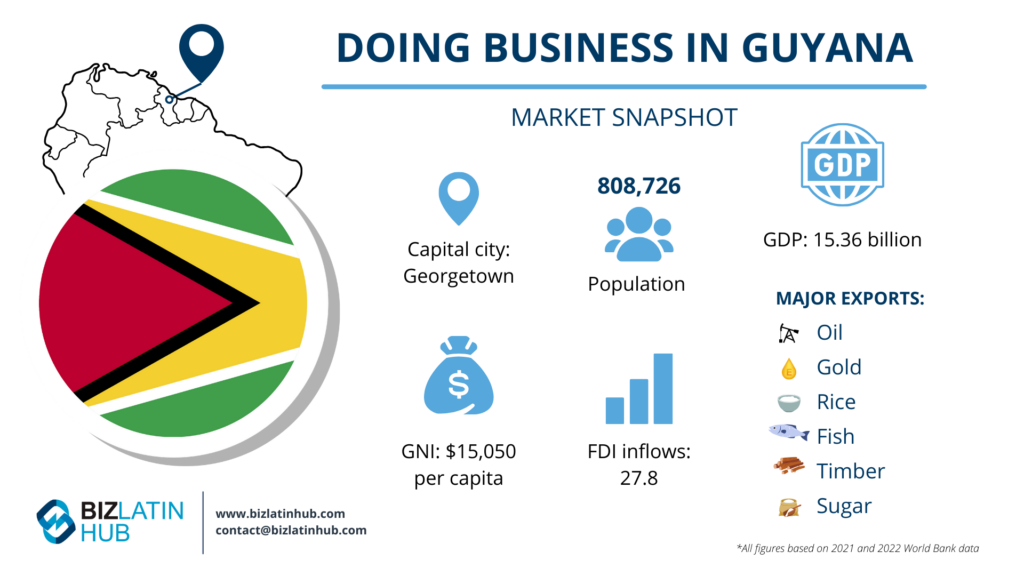

Despite being located on the northeastern coast of South America, Guyana is widely considered a Caribbean country, and is one of three mainland Latin American nations that are members of the Caribbean Community (Caricom), along with Belize and neighboring Suriname. The country also shares borders with Brazil and Venezuela.

Through its Caricom membership, Guyana is a party to free trade agreements with the Dominican Republic and Costa Rica. Meanwhile, the country enjoys preferential access to the US market via the Caribbean Basin Trade Partnership Act (CBTPA) — an expansion of the 1983 Caribbean Basin Initiative (CBI).

Guyana has experienced exponential and almost unbroken economic growth over recent years, with both gross domestic product (GDP) and gross national income (GNI) increasing more than sixfold since 2005, according to World Bank data. By 2019, GDP had hit $5.17 billion, while GNI — a key indicator of overall prosperity among the population — had reached $6,630 per capita, placing Guyana as an upper-middle income nation by international standards (all figures in USD).

The country has also witnessed a major uptick in foreign direct investment (FDI), which increased more than tenfold over a five-year period to reach $1.695 billion in 2019.

Guyana is a major producer of ships and shipping containers, while it also has significant reserves of gold and aluminum ore, with mining activities — as well as the production of related machinery — major contributors to the local economy. Other important export products include cereals and fish.

While Trinidad and Tobago is the number one recipient of Guyana’s exported goods, other major destinations include Canada, Ghana, Norway, and Portugal. According to GoInvest, the Guyanese government’s official investment promotion body, major opportunities for investment can be found in the agriculture, mining, energy, and infrastructure sectors, among others.

If you interested in expanding into this rapidly growing market, read on to understand how working with a PEO in Guyana could be the best option for your business. Or go ahead and contact us now to discuss your business options.

Table of Contents

What can a PEO in Guyana do for you?

A PEO in Guyana will have a locally registered entity that will hire staff on your behalf. That means that while those workers are officially employees of the PEO firm, you will have total control over their daily tasks and working hours.

That means the PEO in Guyana will manage all aspects of payroll related to those workers, paying their salaries and calculating and complying with all statutory benefits, such as sick pay, vacations, and end of employment severance. They will also compute and oversee proper payment of the likes of national insurance, or any other contributions required by local authorities.

A PEO in Guyana will have an established recruitment network and, where needed, be able to take an active role in the recruitment and hiring of the outsourced staff you are seeking. That also means they will be able to lead on the likes of employee on-boarding and off-boarding, including registering and deregistering those workers with local authorities as appropriate.

Legal requirements your PEO will oversee

While a PEO in Guyana will be able to offer expert advice on all relevant aspects of local labor law, when you hire staff through them, you eliminate the need to worry about such concerns, because as part of their service agreement the PEO firm will guarantee your compliance with all local regulations and norms.

Some of the key requirements set out by Guyana’s labor laws that a PEO will take care of for you include:

- A standard working week of 40 hours

- Honoring of all national holidays celebrated in Guyana

- Honoring the legal entitlement related to sick leave

- Employer contribution of 8.4% and employee contribution of 5.6% of each salary to national social security

- Written contracts given to each employee and registered with the relevant authorities

- Timely payment of salaries and any applicable additional payments, such as severance pay when employment ends

Key benefits of using a PEO in Guyana

When you hire staff via a PEO in Guyana, you will enjoy the following benefits:

Cost reduction: While you will have to pay the PEO firm a fee for each staff member they employ and manage on your behalf, those costs are likely to be considerably lower than forming a company and employing a dedicated team to manage their payroll.

Time saving: When you hire through a PEO in Guyana, you eliminate the need to establish a legal entity, meaning you can have staff working for you in weeks, if not days, depending on the profiles you are looking for.

Overcome unfamiliarity: When you enter an unfamiliar market for the first time, the regulatory regime and culture of doing business can be unlike other jurisdictions where you operate. By hiring through a PEO firm, you are able to tap into their expert local knowledge and build up a clear picture of the market, prior to any potential deeper commitment.

Legal protection: One of the key advantages of working with a PEO firm is their understanding of the local regulatory regime and guarantee that you will be in full compliance with it. Knowing that your company will remain in good standing with local authorities gives you peace of mind to focus on other aspects of your business.

Limited commitment: By hiring staff through a PEO and eliminating the need to register a business locally, you are able to enter and leave the market in only the time it takes to find and release local staff, allowing for a swift and inexpensive departure from the market based on what your commercial strategy demands.

Established network: As well as an established recruitment network that can help you find the right staff quickly, your PEO in Guyana will also have strong connections to the local business community, which may be beneficial to your enterprise in other ways.

Hiring Local Talent with a PEO in Guyana

A dependable PEO in Guyana can manage the complex nature of various employment agreements within the nation. The main employment guidelines overseen by a Guyanese PEO are:

- Working Hours: The standard workweek spans 40 hours over 5 days, with overtime compensated at one and a half times the regular rate.

- Holidays: Guyana celebrates 15 national holidays, and employees are entitled to 12 days of annual leave.

- Sick Leave: Sick leave is not an entitlement. Employees are allowed both certified and uncertified sick leave. Payment for sick leave is made by the National Insurance Scheme after the third day of illness. Most Collective Agreements require the employer to make up any shortfall.

- Maternity/Paternity Pay: The maximum paid maternity leave period in Guyana is 13 weeks.

- Tax: Individuals who are ordinarily resident or domiciled in Guyana are subject to tax on their worldwide income. Individuals who are not ordinarily resident or domiciled in Guyana are taxable on income accruing in or derived from Guyana, including income from any employment exercised in Guyana, regardless of whether the income is received in Guyana.

- Value Added Tax (VAT): Taxable activities for purposes of the Guyana sales tax are sales of goods or supplies of services within Guyana and the import of goods.

- The standard rate is 14%. Certain goods and services may be zero-rated or exempt.

- Social Security: Contributions to the NIS are paid at the following rates on maximum monthly insurable earnings of GYD 280,000: For employees: 5.6% For employers: 8.4%

- For self-employed persons: 12.5% (of their declared income up to GYD256,800.)

- Termination of Contracts: Employees with less than one year of service require a two-week notice, whereas those with over a year need one month. Employers can’t terminate during authorized leaves and can dismiss instantly for serious misconduct. Employees with over a year of service are entitled to severance pay, increasing with years of service up to a maximum of 52 weeks.

Access PEO services in Guyana with Biz Latin Hub

At Biz Latin Hub, our team of multilingual PEO specialists is ready to help you find the staff you need in Guyana and ensure your good standing with local authorities from the first day of operations. With out expertise in providing back-office services to foreign investors, including commercial representation, legal services, and accounting support, we can help you achieve your business goals in Guyana. We are present in 16 countries around Latin America and the Caribbean, and have trusted partners in many others.

Reach out now for further advice or a free quote.

Or learn more about our team of expert authors.

The information provided here within should not be construed as formal guidance or advice. Please consult a professional for your specific situation. Information provided is for informative purposes only and may not capture all pertinent laws, standards, and best practices. The regulatory landscape is continually evolving; information mentioned may be outdated and/or could undergo changes. The interpretations presented are not official. Some sections are based on the interpretations or views of relevant authorities, but we cannot ensure that these perspectives will be supported in all professional settings.